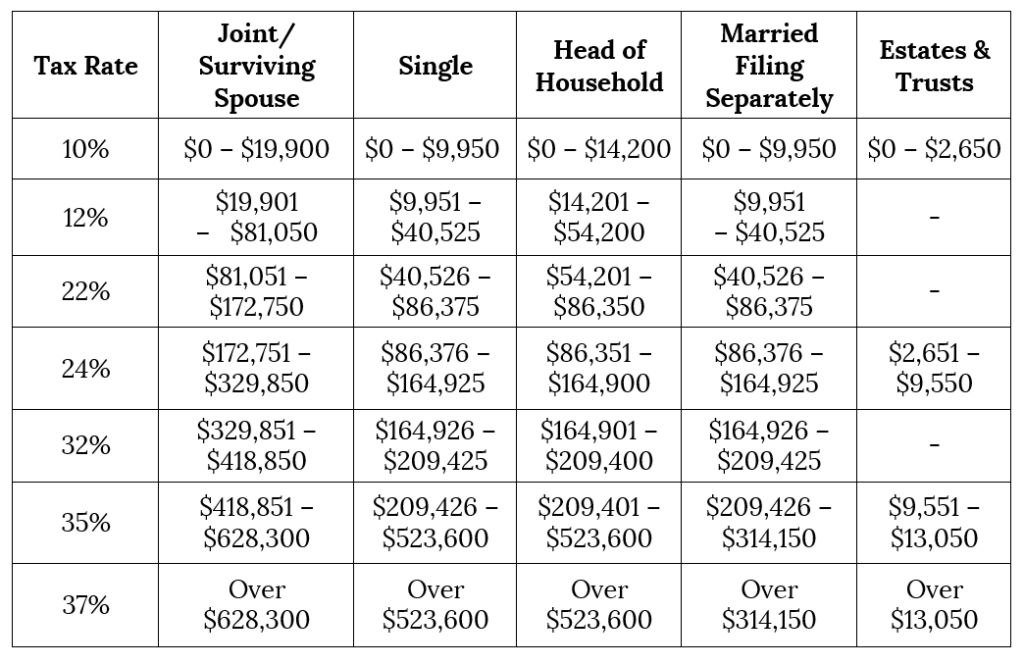

As you review the tables below, keep in mind that your bracket depends on your taxable income and filing status. This means that nearly 40,000 in individual income will be taxed at 35 instead. This report outlines a number of projections, including penalty amounts for failure to file, retirement planning figures, and income threshold, deduction and exemption amounts. Get better acquainted with the 20 tax brackets, the various filing statuses, and the difference between taking the standard and itemized deductions. For the top individual tax bracket, the 2023 income threshold was raised to above 578,125 versus 539,900 in 2022.

#2023 tax brackets plus

When your other taxable income (after deductions) plus your qualified dividends and long-term capital gains are below a cutoff, you will pay 0 federal income tax on your qualified dividends and long-term capital gains under this cutoff. taxes income at progressively higher rates as you earn more. "Once again, our annual report provides actionable projections for tax professionals and taxpayers to begin planning for the upcoming year ahead of the official IRS announcement." Don’t be afraid of going into the next tax bracket. What are the tax brackets for 2023 The U.S. Those ratesranging from 10 to 37will remain the same in 2023. inflation has contributed to a significant increase in inflation-adjusted amounts in the tax code," said Heather Rothman, vice president of analysis and content at Bloomberg Tax & Accounting, in a statement. What are the tax brackets for 2023 The U.S. For the SECURE 2.0 Act, changes include an increase in the wage limitation amount for the additional Section 45E credit for small employer pension plan startup costs from $100,000 to $140,000. For the Inflation Reduction Act, changes include an increase in the Section 4611(c) hazardous substance superfund financing rate and a bump up in the Section 179D deduction for energy-efficient commercial building property as long as new wage and apprenticeship requirements are met. View how much tax you may pay in other states based on the filing status and state entered above.The Blomberg report takes into account the tax changes made under last year's Inflation Reduction Act and the SECURE 2.0 Act. Here is a list of our partners who offer products that we have affiliate links for. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers' offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers' offers appear on the site. First, we provide paid placements to advertisers to present their offers.

This compensation comes from two main sources.

#2023 tax brackets for free

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective.

0 kommentar(er)

0 kommentar(er)